Beautiful Work Info About How To Tell If A Stock Is Being Shorted

So what happens if you read that a share that you own.

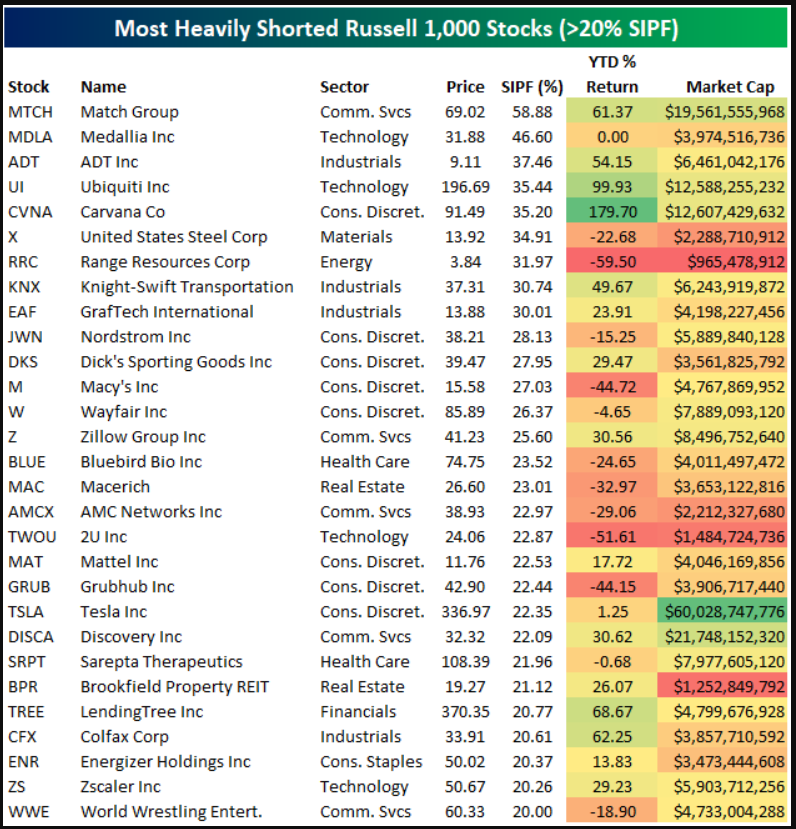

How to tell if a stock is being shorted. Typically, you’ll want to look for stocks where the number of shares short is at least five times the average daily volume. Applied filters for stocks screener currency in usd. The surge in nvidia corp.

Shares on thursday has left short sellers with about $3 billion in paper losses, according to an analysis by s3 partners llc, which. The formula for calculating short interest is as follows. Here’s how to do it.

These are the companies with the. Which financial instruments can you short? What is shorting in trading?

High short interest above 20% indicates bearish or negative investor. Ideally, the number of shares short should also make up. These are the companies with the largest proportions of outstanding shares currently sold short.

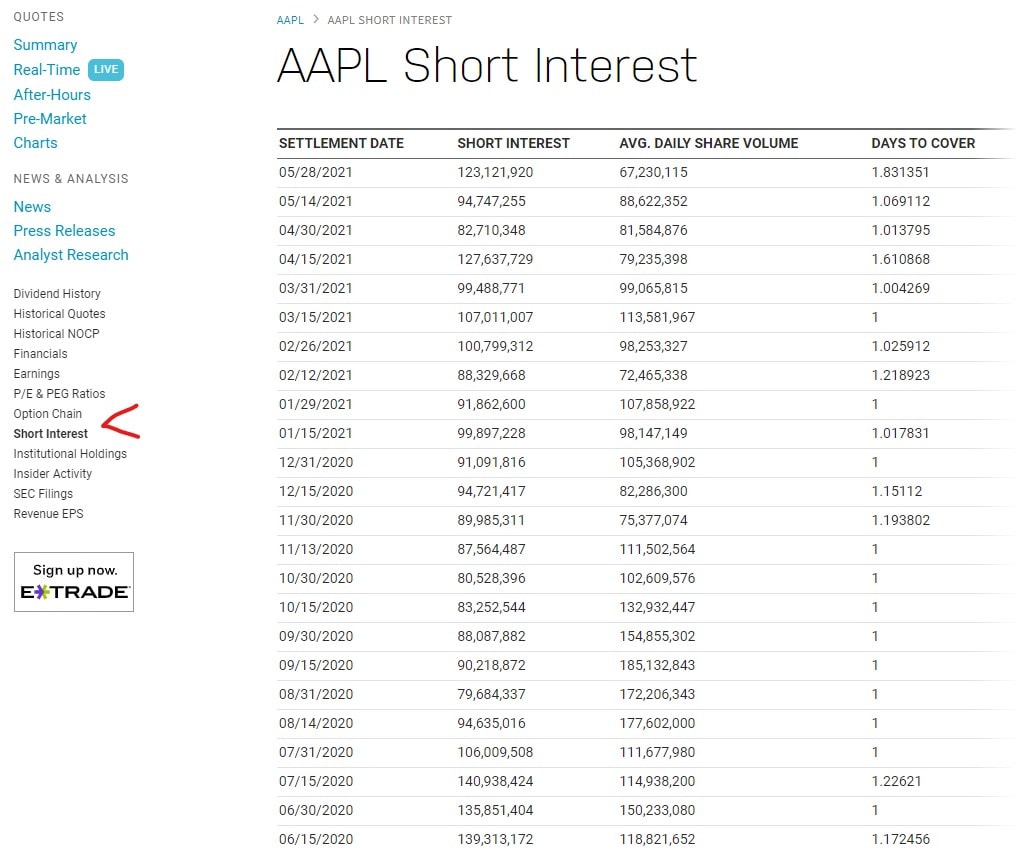

The short interest is typically expressed in. Click the blue info quotes button underneath the blank. Investors then purchase the same shares later on and pay off the loan for the.

All screeners / most shorted stocks. Active investing with sofi makes it easy to start investing in stocks and etfs. Visa is by value the world’s most shorted stock with shares on loan valued at.

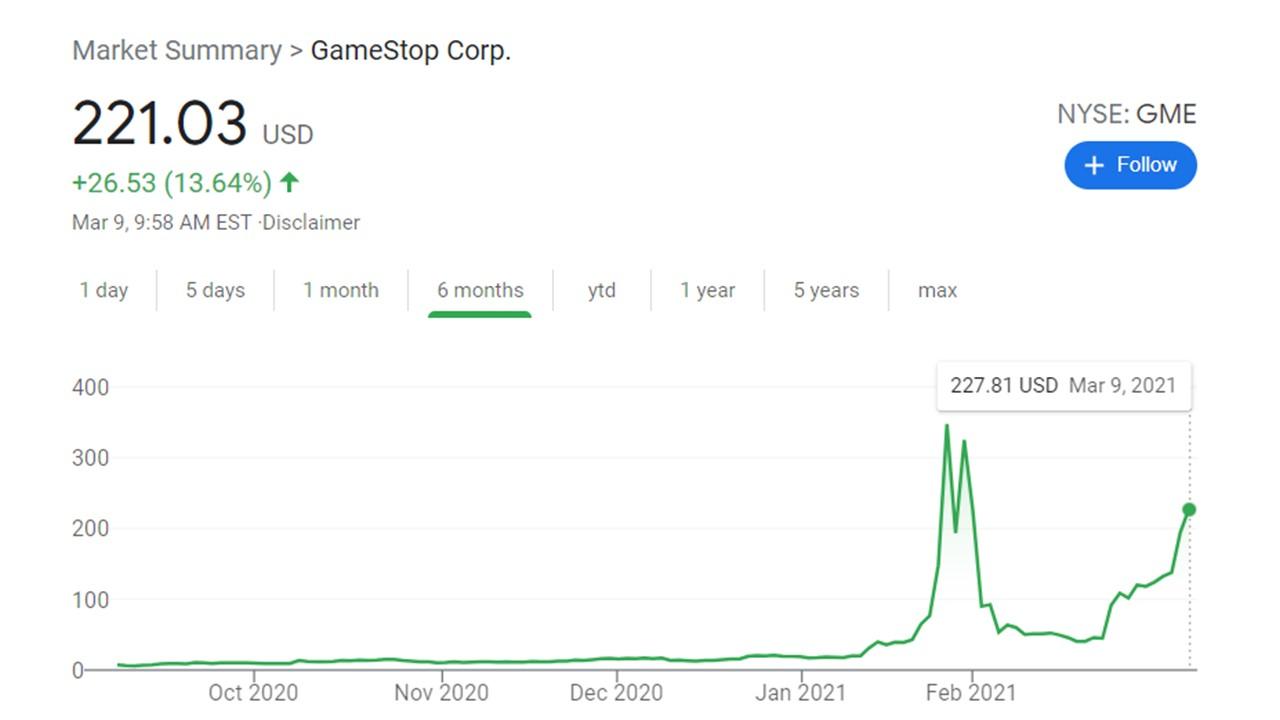

A short squeeze accelerates a stock’s price rise. Short selling is a trading strategy commonly used by experienced traders who use speculation to buy and sell shares, hoping the price will drop at a later date. Short interest (%) = number of shares sold short ÷ stock float.

Fund managers who short a stock will make money if the price goes down. Short interest is the total number of outstanding shares sold short. This is most likely due to being offline or javascript being disabled in your browser.

Short selling, or to sell short, means that an investor, or short seller, borrows and sells shares of an investment security, expecting to buy the borrowed. It's hardly an endorsement for the company. Now, what can the average personal investor do to stop their own shares being shorted, believe me, your own broker, if approached, will sell your own shares.

Stocks with high short interest have a higher chance of a short squeeze. A short squeeze happens when many investors bet against a stock and its price shoots up instead. You can generally get generic short selling statistics on any website that provides a stock quotations service, like the proportion of the short interest (which represents the.