Recommendation Tips About How To Start A Tax Exempt Organization

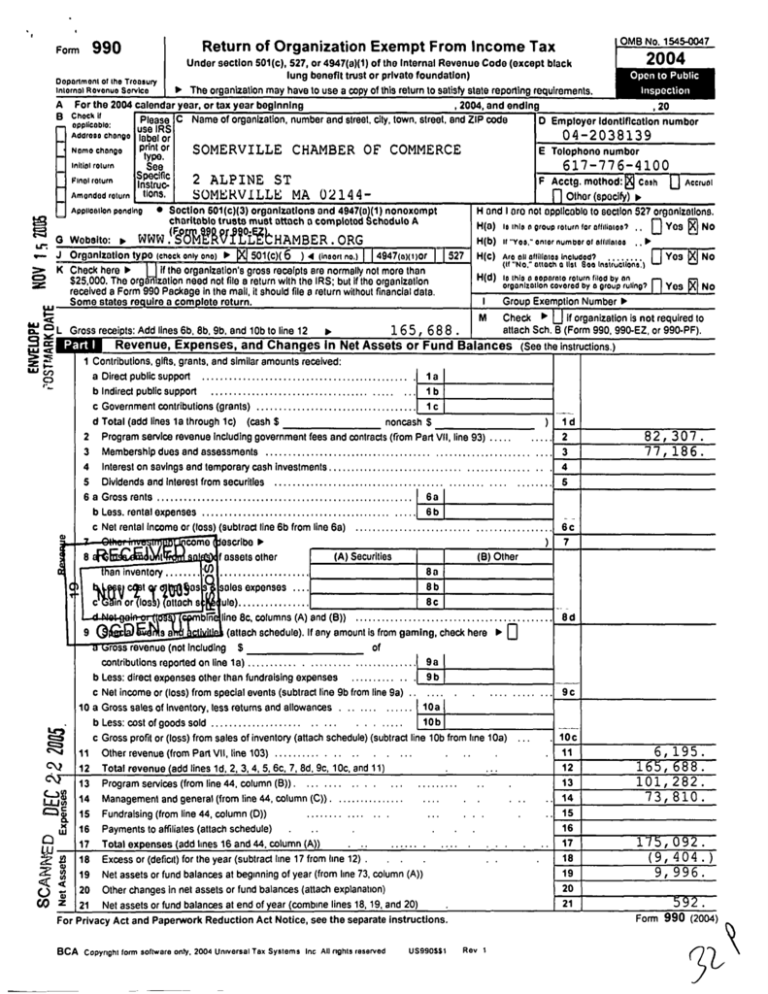

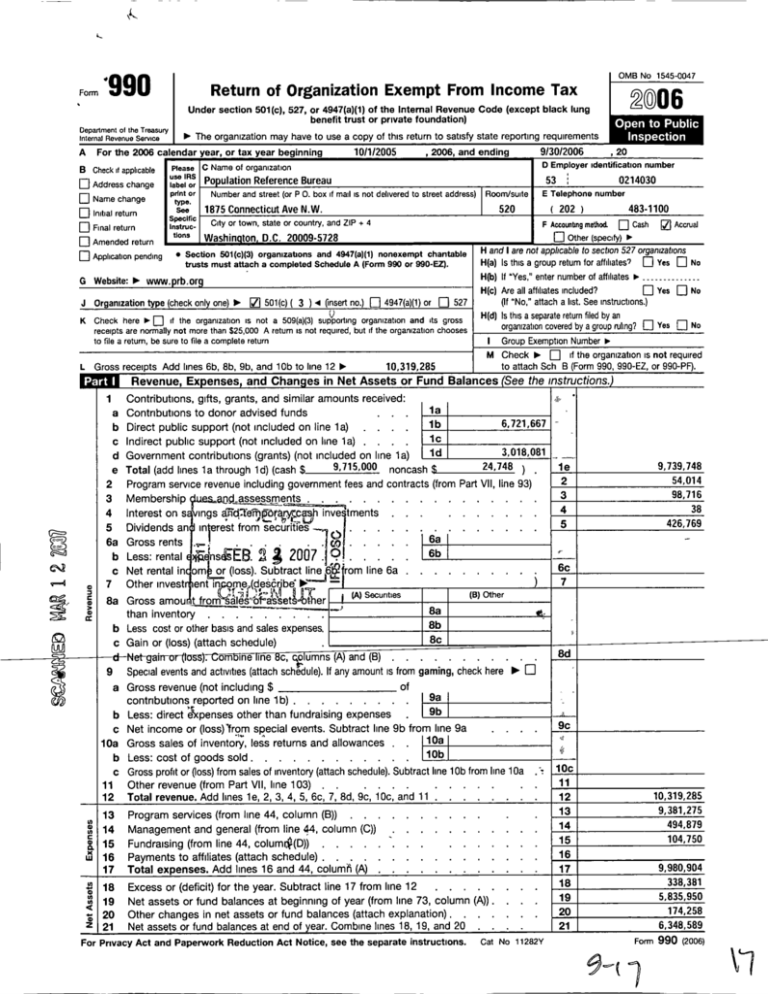

Form 990, return of organization exempt from income tax.

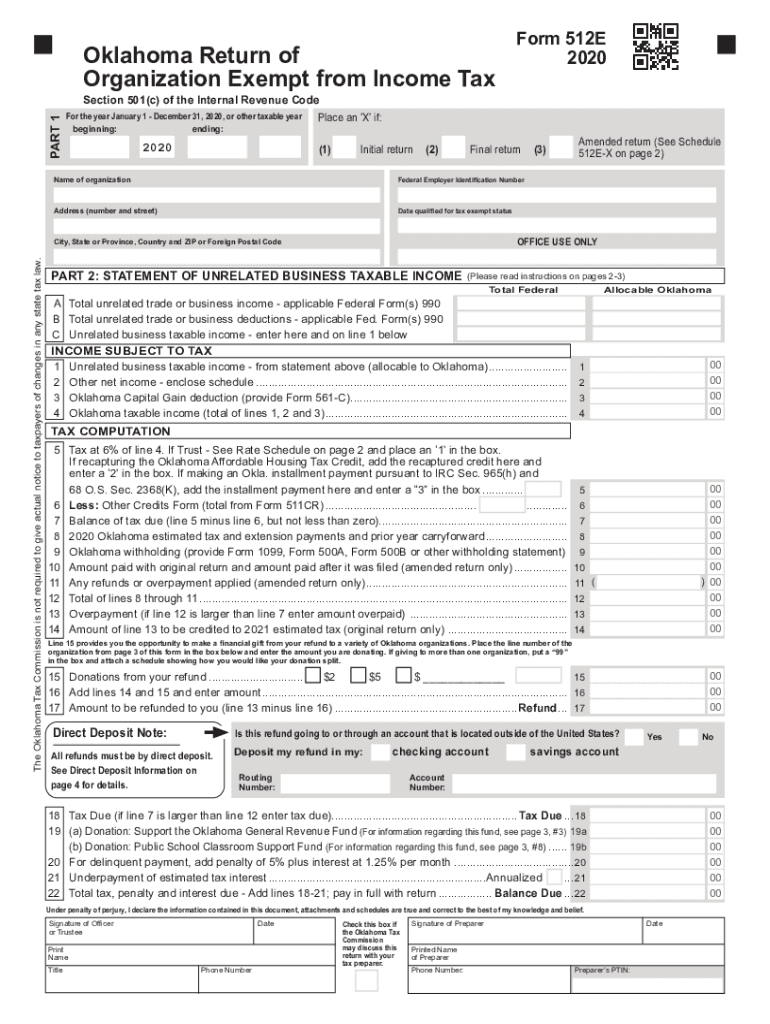

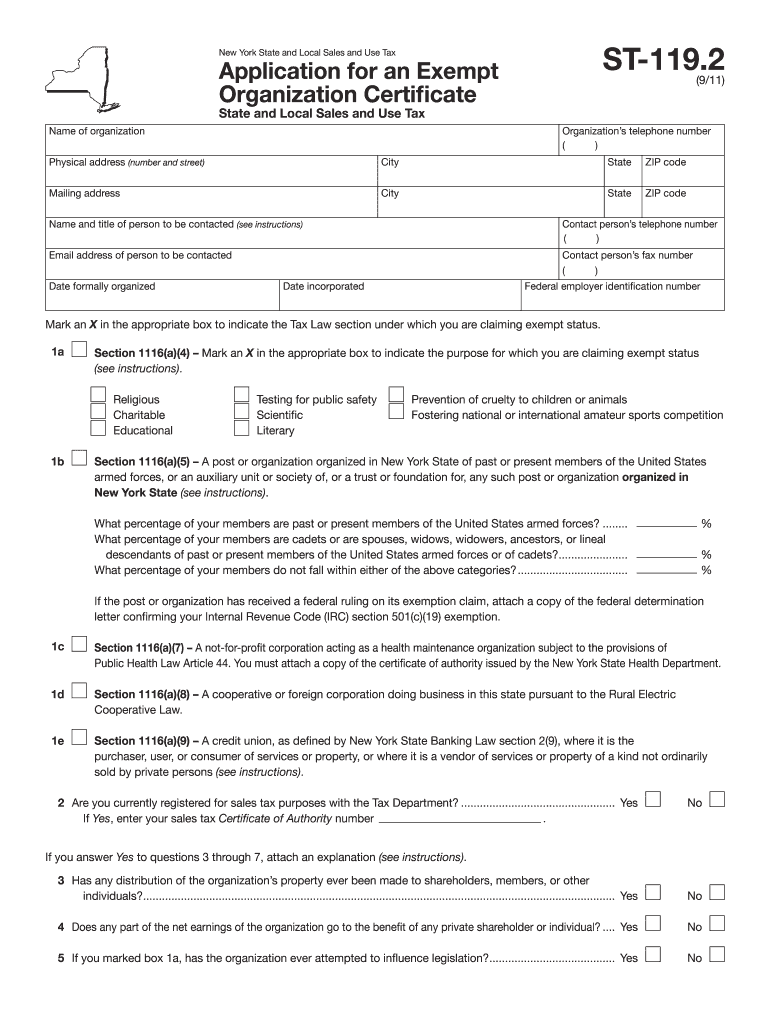

How to start a tax exempt organization. A nonprofit organization may be created as a corporation, a trust, or an unincorporated association. Creating your own corporation entails coming up with a permissible and unique name, preparing your articles of incorporation, appointing directors to oversee the activities of. The steps that go into starting a 501 (c) (3) include choosing a name for your nonprofit, writing your purpose statement and bylaws, recruiting and establishing a.

Whenever you feel ready, you can make your donation. The first step is to create a nonprofit organization. A nonprofit organization will not be.

How to start a nonprofit | step 2: Every nonprofit has an initial board of directors to comply with both state law in the state of incorporation and the irs. It always starts with an idea:

If you are donating cash, you may be able to use an. Us roller cup was started with the idea of what if there was a tournament series that used its p. Donate to the 501 (c) (3) nonprofit organization.

You want to solve a problem in your community, conduct research into a disease, or raise awareness of an important issue. The first stage in the life cycle of any organization is its creation. Instructions for form 990 pdf.