Awe-Inspiring Examples Of Info About How To Get A Secured Credit Card

Advertiser disclosure how to choose a secured credit card:

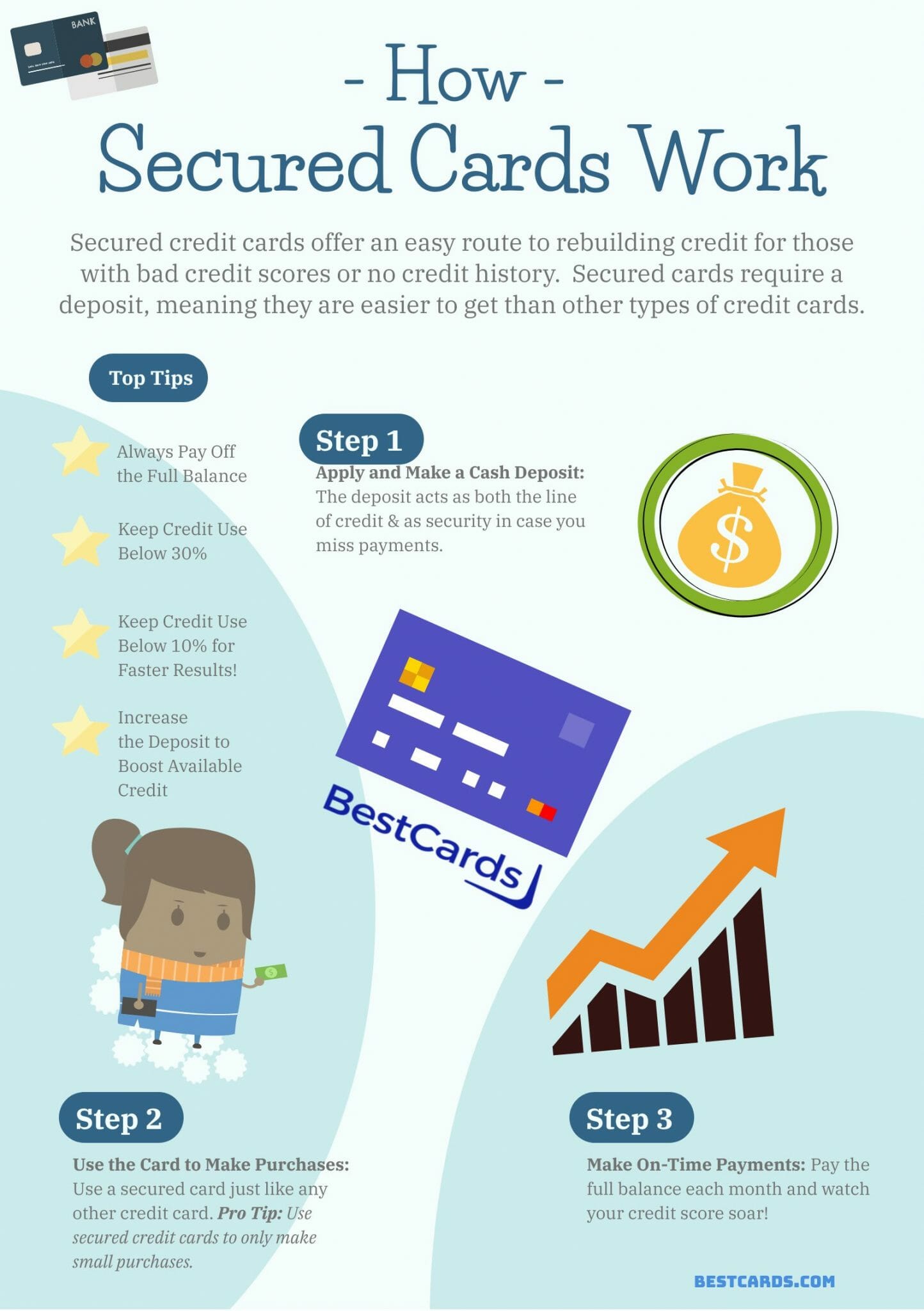

How to get a secured credit card. With the monthly payment in mind, confirm whether you can realistically manage payment in your. Key things to know about secured credit cards. Secured credit cards eliminate the risk to the lender.

Secured credit cards eliminate the bank’s risk while giving you the ability to build your. The limit may be the same amount as the deposit or more—depending on the issuer. Best for quick approval:

The first progress platinum elite mastercard® secured credit card. Either cash back or rewards points. Get it, use it to improve your credit enough to qualify for better options, and then move up to an.

Secured credit cards, in essence, are tools designed for building or rebuilding credit. This means if you put down a security deposit of $300 to get a credit limit. Calculate what your monthly payment would look like for each loan (if it wasn’t already provided).

It’s easy for the creditor to just take the money securing the card if you. A secured credit card is a tool designed for people with bad credit who want to build or rebuild a positive credit score. These are our picks for the best secured credit cards.

For example, if you deposit $500, then your credit limit will. Secured credit cards are the easiest type of credit card to get, and they usually have low annual fees. Your credit limit on the card is equal to 100% of your security deposit versus only 90% on the bvva compass secured visa.

Get a secured credit card. A secured credit card can also help you build or rebuild your credit, just like a “normal credit card.” compare secured credit cards. Your credit limit is generally equal to the security sum that you.

That said, these cards come with a. Don’t get hung up on interest rates or. We’ll match all the cash back rewards you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods.you’ve earned cash back rewards only when they’re.

A secured card is a credit card that requires a cash deposit. These credit cards require a deposit, referred to as a “security sum”, which is held by the card issuer while you have the card, and returned to you when you close the account. The financial institution you’re working with may check your credit history.

How does a secured credit card work? Secured credit cards are designed for people with bad credit who want to build their credit score. Best for no checking account requirement:

/DiscoveritSecured-5a6f549f8e1b6e00378a25dd.jpg)