Awe-Inspiring Examples Of Tips About How To Clean Up Your Credit Score

We have compared credit scores to weight loss;

How to clean up your credit score. The first step is to get your credit reports from each of the three credit. Read on to learn exactly what you can do about your credit report. Get organized with a calendar or reminder system.

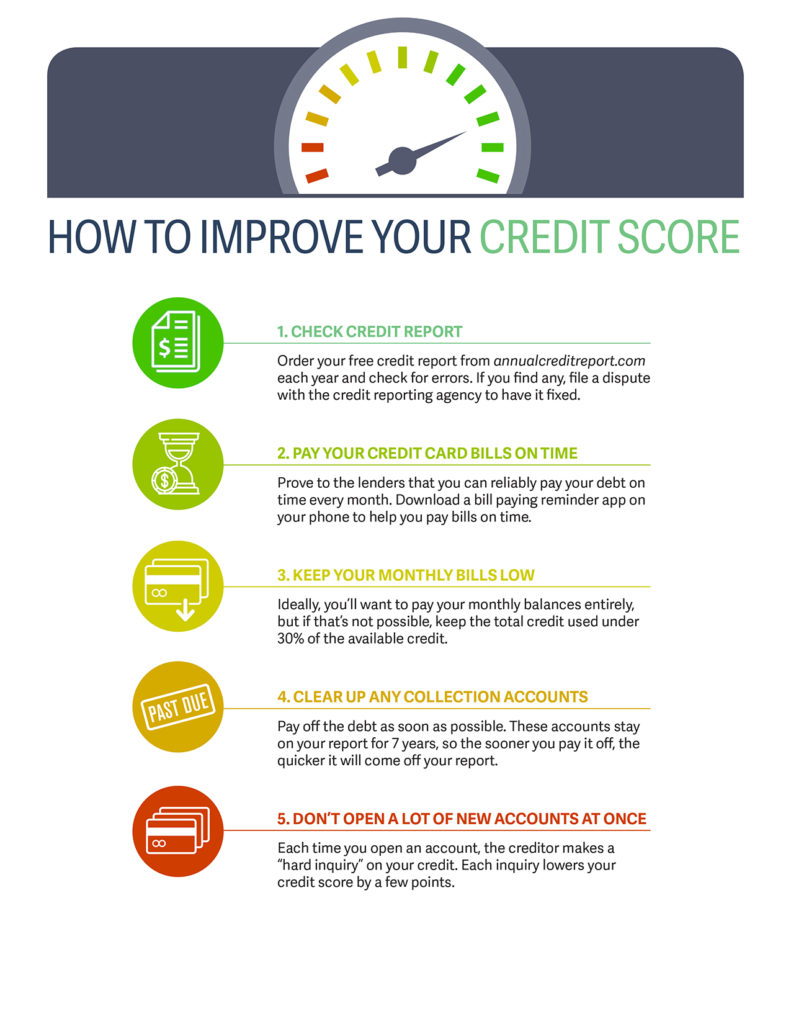

After you’ve viewed your report, noted the errors, and resolved any disputes, you may be wondering what else you can do to raise your score. Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit increase. How to clean up your credit report 1.

Paying bills, on time and with consistency. Pay on time.

Here’s the basic procedure: If you're tired of dealing with inaccurate, unfair, or outdated information that is negatively impacting your credit score, you're not alone. Here are seven steps you can take to begin improving your credit score.

There’s not an exact answer to that, as each person’s financial situation is unique and complex. Contact the creditor to see if they’ll correct the mistake and notify the credit bureaus. Get my free credit report such issues aren’t always apparent.

Keeping account balances low, ideally using less than 30% of the credit available. Here are the ranges experian defines as poor, fair, good, very good and exceptional. Here's how to build credit fast:

Start by reviewing your report Verify which credit reports the late payment appears on. Your credit report contains information about how you’ve used.

There are three basic steps to a successful credit cleanup: Under the fair credit reporting act, you’re entitled to one free credit report every year. If necessary, contact the credit bureaus to dispute the late payment.

Get copies of your credit reports most people only need to be concerned with credit reports from the three main credit reporting bureaus: Or it could prove to be a simple administrative error. See his story in the video above.

Raising your credit score in 30 days. The answer is yes, especially if you care about your credit score. Credit bureaus gather credit information on your borrowing, debt and payment history.