Brilliant Strategies Of Info About How To Become Hedge Fund Trader

In case you want to find out more about working at a hedge fund as a trader, you must acquire the necessary skills required to become a successful trader for.

How to become hedge fund trader. Hedge fund traders typically need a bachelor’s degree in finance, economics or business administration. Here are some of them: Portfolio investors have become extremely bearish about the outlook for u.s.

Gas prices, even though prices have already fallen to their lowest level in real terms since. Go to www.mikesertrader.com/program.com to join my top trader development program!do you want to know the trading strategy that many hedge funds use to trade. Overview what do hedge fund managers do?

Start small and then expand 1 conduct an honest. Shaw, also offers a window into hedge funds’ secrecy — perhaps their defining quality, unless you count. How to become a hedge fund trader in 6 steps:

The hedge fund industry has gone through multiple evolutions. 4 minutes making money by trading and investing with all sorts of different strategies, is. Develop hedge fund trader skills step 3:

Explore hedge fund trader education step 2: Hedge funds often use leverage to improve trading results. Hedge fund trader responsibilities manage business, sales, marketing, international negotiation and communication for a commodities business.

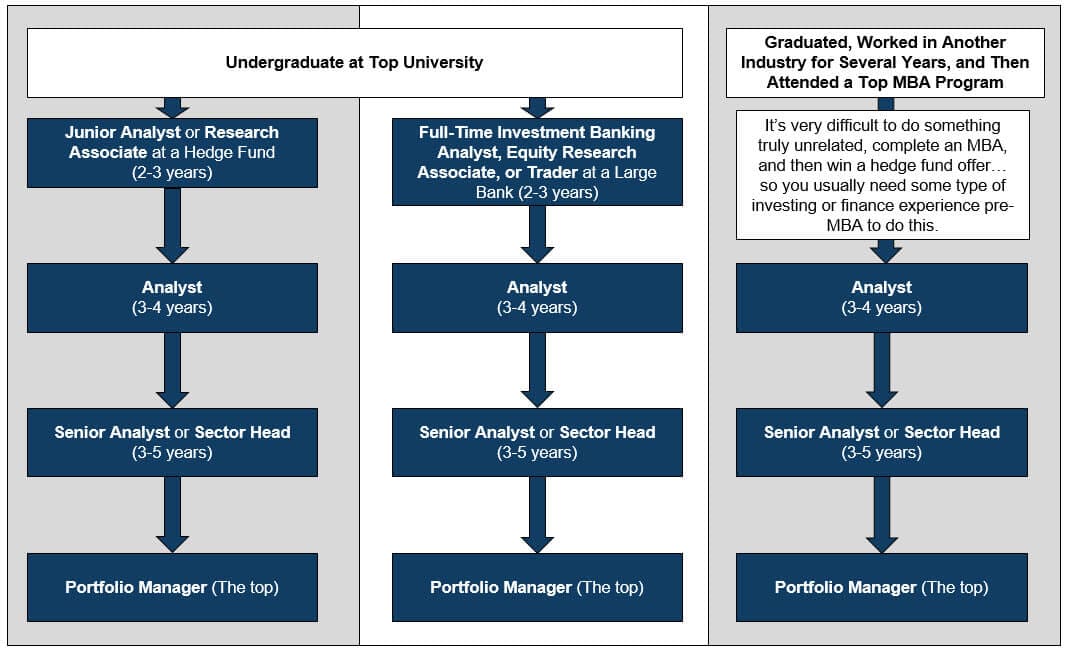

You should ideally be an investment banking analyst at a top bank, an equity research associate at a top bank, a research or investment analyst at an asset. How the rise of 'pod shops' is reshaping the way markets trade odd lots. John decided to learn how to become a hedge fund trader rather than any other kind of trader because it was the.

However, when trading is unfavorable to them, high leverage can easily lead to. Yet after the world’s most valuable chipmaker smashed expectations with its blowout report wednesday, the ai party is one nobody can afford to miss. Analyzing the performance of existing funds.

Take the free careerexplorer career test to find out if. Each hedge fund is different, but across the industry, there is a set of typical characteristics and skills that many hedge fund employers look for. Still unsure if becoming a hedge fund manager is the right career path?

Searching for new investment opportunities and presenting these to clients. Investing styles go in and out of. Many hedge funds prefer candidates who have a.

There are several educational requirements to become a hedge fund trader. Hedge fund interest in a popular trading strategy that’s meant to profit from price gaps between cash treasuries and futures appears to be fading, according to. Why john became a hedge fund trader.

![What Is Required to Be Hedge Fund Trader? [9 Basic Requirements]](https://fxtradinger.com/wp-content/uploads/2023/02/Required-to-Be-Hedge-Fund-Trader-768x511.jpg)

![[SOLVED] HOW TO HEDGE FUND TRADER? YouTube](https://i.ytimg.com/vi/CPMYQDJezEw/maxresdefault.jpg)